It’s official! On my return from the NAPF Conference I told my wife that I was indeed a fully fledged ‘pensions nerd’. My ‘fledging’ was conclusive and its confirmation unequivocal; I had really really enjoyed the annual conference.

Now, you may think that that is not entirely conclusive proof. After all, we did have a captivating and entertaining session from Sir Bob Geldof who, despite everything we were told as a child, made it his personal mission to show us that swearing is in fact ‘big and clever’. We also had another entertaining and enjoyable ‘performance’ from Steve Webb, a great Gala Dinner and a fun session with Dr. Steve Peters to name some selected highlights. Add to that some interesting stream sessions over the three days and an enticing array of entertainment and refreshments on the stands and you have a pretty decent recipe for success. The proof of my nerdiness lies simply in how much I enjoyed just talking pensions to the many people that I met over the three days.

One of the hot topics was Collective DC (‘CDC’), especially after Steve Webb revealed that the interactive voting had seen support for CDC plummet from 80% (before the CDC session) to 57% (at the end). This flushed out a lot of fairly negative views about CDC. These views raised real concerns one of which – primarily about trust based DC – was “why would anyone do that?”

So, why would a trust based scheme want to offer CDC?

Let us set aside the issue of cost. If a trust based DC scheme offers CDC then its governance budget has to increase. For the time being we will assume that the employer is OK with this and will support the trustees’ decision. We will revisit why they might want to do this later.

As a trustee, I can see some real benefits that a CDC option might provide to members. Here’s my thinking on this.

As we know, many trust based DC schemes were spawned from the closure of DB schemes; firstly to new entrants and then subsequently to future accrual. These schemes often have relatively high contribution rates and, as a result, long serving members may reach retirement with decent benefits in the form of both a legacy DB pension and a sizeable DC pot.

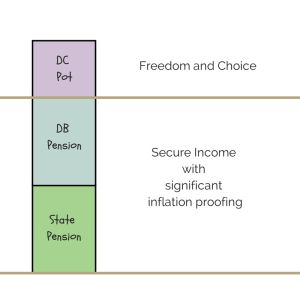

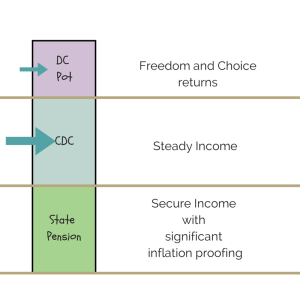

The shape of a long-serving member’s benefits might end up looking something like this:

For this member the combination of State Pension and DB pension provides a sufficient level of secure income.

This security allows the member to take full advantage of the new ‘freedom and choice’ with their DC pot.

The DB accrual also means that this member retains a semblance of a Normal Retirement Age (‘NRA’). Whilst this is not cast in stone, it does add a focal point for retirement planning.

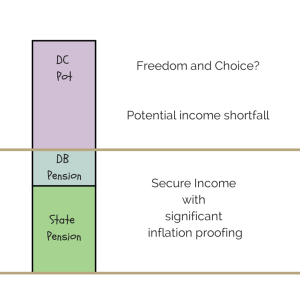

Over time of course the number of members with appreciable DB accrual will begin to diminish. In the fairly near future, members might reach retirement with benefits that look more like this:

This member has less in the way of secure income. Their income might not be sufficient to meet their day-to-day living costs.

This member has less in the way of secure income. Their income might not be sufficient to meet their day-to-day living costs.

The benefits of ‘freedom and choice’ start to diminish as the risk of an income shortfall arises.

This member still has an NRA, but the lack of certainty in terms of retirement income can hamper their retirement planing.

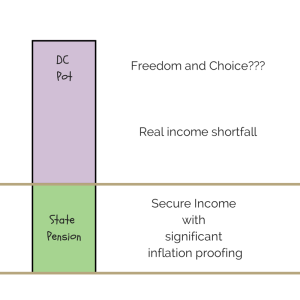

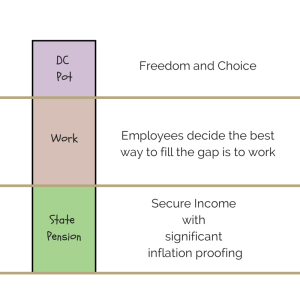

This phenomena will increase over time as fewer members have the benefit of DB accrual. Eventually it will become the norm for most members to reach retirement with no DB accrual. Their benefits may look more like this::

In this scenario the benefits of ‘freedom and choice’ are seriously eroded by the very real income shortfall.

In this scenario the benefits of ‘freedom and choice’ are seriously eroded by the very real income shortfall.

The member has some difficult decision to make if they are to enjoy a secure retirement.

With no DB benefit there is no such thing as an NRA. The focal point will shift to the State Retirement Age (‘SRA’), but increasingly, SRA may turn into a mere trigger for the payment of the state pension. It may not be sufficient to facilitate genuine retirement.

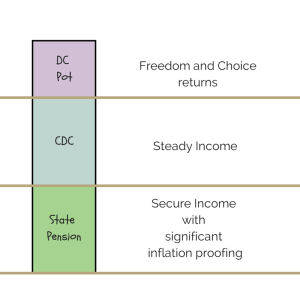

This is where CDC might fit in. If we can build CDC into the space vacated by DB – albeit with no guarantees and somewhat less certainty – we can rebuild a proposition that is attractive to members and allows them to exercise ‘freedom and choice’ on their conventional DC pot.

One of the key advantages of CDC would be the idea of the target income.

One of the key advantages of CDC would be the idea of the target income.

A target income is a simple idea for members to understand. Not only does it add some substance to retirement planning, it also translates into some some straightforward and effective planning in the form of a required contribution rate.

I see this working particularly well in tandem with conventional DC. Let us assume that a scheme allows members to fund conventional DC, CDC or a mix of both.

The initial contribution rate into the CDC pot would be based on a target income at a target age.

Any residual contributions could go into conventional DC. This allows the member to fund for income and to potentially benefit from ‘freedom and choice’.

Any residual contributions could go into conventional DC. This allows the member to fund for income and to potentially benefit from ‘freedom and choice’.

The beauty of this system would become clear at those times when CDC contributions might need to be increased to achieve the target income.

The contributions into conventional DC could simply be diverted to the CDC section for however long it took for the CDC to get back on track.

From the members’ perspective this is more palatable because their overall contribution rate may not need to go up. In good times the reverse could happen, with excess contributions diverted to conventional DC.

This combination of a target income with some risk sharing might work well from the members’ perspective but, as I stated at the outset, it does require the support of the employer. Which brings us back to a modified question: why would any employer do that?

If employees do not have sufficient income to retire they might decide – as is their right – to fill any income shortfall with work.

If employees do not have sufficient income to retire they might decide – as is their right – to fill any income shortfall with work.

Whilst in principle this may be OK, there is a huge difference between people who work on into old age because they genuinely want to and those who feel they have no alternative.

Whilst there can undoubtedly be some benefit in retaining experienced staff and many employers will want to accommodate employee requests for flexible working, there does have to be a sense of balance.

A forward thinking employer might recognise that facilitating a good level of retirement income is beneficial for all concerned and CDC might just be a way to make good retirement outcomes possible

JPR